Sanlam Indie

Life Insurance that creates wealth.

Get world-class cover plus a growing Wealth Bonus at no extra cost.

Starting from R100 pm

MONEY BACK

Get insured. Get Wealth Bonus.

Up to 100% of every payment is matched into a benefit that tracks the market like a real investment. Get insurance that helps create wealth for your future.

PRODUCTS

Simpler, smarter, more rewarding cover.

We think life insurance should be more about living. So we’ve designed our products to protect and create wealth while you're alive.

WHY SANLAM INDIE?

Built from the ground up for the internet generation.

Sanlam Indie is a digital-first insurer, using technology to make life insurance simpler, smarter and more rewarding.

Do everything online in no time.

Get quoted and covered in under 10 minutes online. No paperwork or waiting.

Better technology gives you better value.

We've eliminated old analogue processes with state-of-the-art tech that works better and costs you less.

Don't just get insured, create wealth.

Every Sanlam Indie policy has a built-in Wealth Bonus, and we contribute to it every time you pay your premium.

You're covered instantly with Sanlam Indie.

Buy your insurance online and get instant cover, before you've even paid for it.

Better insurance, at the best possible price.

We use state-of-the-art technology to give you a more accurate premium, with lower premiums if you're lower risk.

Skip premiums. For when life happens.

Sanlam Indie lets you proactively skip premiums without losing cover or reducing your Wealth Bonus.

CLAIMS

We've paid out

R 87,33 million

in the last 5 years*

At Sanlam Indie we find reasons to pay, not the other way around. Our claims process is simple and straightforward.

*Last updated August 2022

CLIENT REVIEWS

Don’t just take our word for it.

Independent Rating of 4.1 from 448 clients

I would like to offer my apologies for canceling the policy. I wish to express my profound appreciation to your employee who called me. She was so professional, calm, kind, well-spoken, articulate, sought to understand, and very respectful, she really knew her job description.

Adelice

21 Apr 2022

It was my first claim, so far I am impressed with the quick assistance, communication was good.

Amile

07 Feb 2022

At first I was not happy due to I have been paying for Life Cover for more than 2yrs with no documents. All thanks to Zama for keeping your promise. Documents received and all is in order I’m now a hapy client. Thank you so much for going above and beyond.

Violet

21 June 2022

I am pleased with the assistance however we can still improve on the telephonical service. Keep up the good work

Alex

01 Apr 2022

Excellent customer service. Thank you. You can improve by educating your consultants more about your products so that you don't have any more cases like this one.

Malusi

12 Apr 2022

Good day few minutes ago i sent an email requesting that you resend the policy documents as i could not open them , kindly be advised that i ultimately managed to open the documents and please no need to resend, thanks and regards.

Paige

18 May 2022

The service was great.

Zoleka

04 Apr 2022

I am currently happy with how my query was resolved. Thank you so much for the quick response and delivering on your promise.

Corey

20 June 2022

I'm happy with the service and quick pay out, you guys are the best and I will continue to be your member for many years to come.

Zwalina

24 Aug 2022

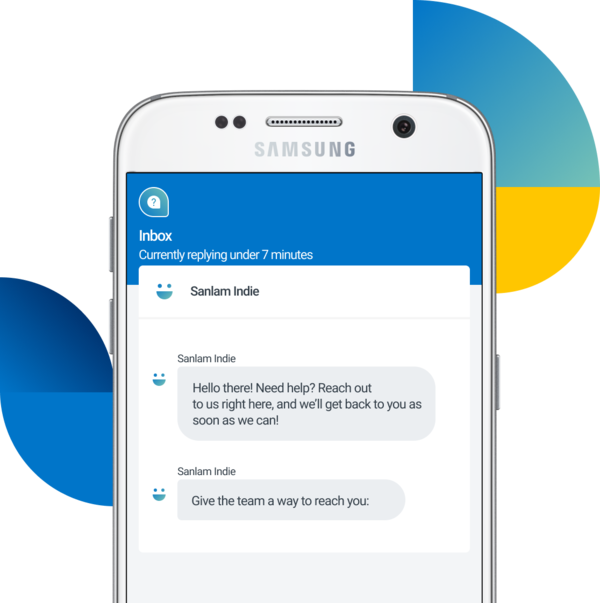

SUPPORT

Friendly and helpful support when you need it.

Insurance is a tricky subject, but with Sanlam Indie, help is always at hand. Check out our Help Centre, get qualified assistance through live chat, or email us.

Get life insurance.

Get Wealth Bonus.

Get living.

Get world-class cover that rewards you with wealth while you're alive.

We're on a mission.

At Sanlam Indie, we're using cutting-edge technology to transform the industry and deliver financial services that actually work for you.

No jargon. No messy paperwork. Just world-class products that are simple to use, easy to understand, and incredibly rewarding - allowing more ways for you to create and protect wealth.

Copyright © Sanlam Indie 2022. All Rights Reserved. Sanlam Indie's product offering is underwritten by Sanlam Life Insurance Limited, a licensed life insurer & financial services provider. Sanlam Indie is a division of Sanlam Life Insurance Limited - Reg No. 1998/021121/06. Sanlam Life Insurance Limited is an authorised FSP (No. 2759). Address: 1st Floor Glacier Place, 1 Sportica Crescent, Tygervalley, Cape Town, 7530

Privacy | Terms of Use | Promotion of Access to Information Act