Disability Cover

- Built-in Wealth Bonus

- Flexible premiums

- Immediate cover

Instant, online, in minutes

ABOUT DISABILITY COVER

Pays you a lump sum to help cover all the costs associated with setting up a new life.

Everything you need to know including the cover, payouts, claims, premiums and more.

How much Disability Cover do I need?

Most people choose to have at least R350,000 of disability cover, but opt for about 6 months of income (after tax but before other deductions) if that’s higher. We’ll help you work out what cover you need in just minutes.

How are Disability Cover claims paid?

We’ll pay all claims as fast as possible. How long that’ll take depends on the nature of the claim, as well as how quickly we’re given the claims documentation.

Can I skip a premium?

You can skip a total of 6 premiums during the first 3 years of having an active policy. You'll still be covered, but your cover will be temporarily reduced until you make up the payment. If you skip all 6 premiums, and you don't make up the last payment before your next billing date, your policy will lapse and your cover will fall away. Any claims made during this period will not be paid out.

How long will I be covered?

The cover will end when you turn 70. Obviously, if you die, then the cover will also stop. If you retire before turning 70, you must remove this product, since you will not be able to claim if you are no longer earning an income from your job.

MONEY BACK

Get insured. Get Wealth Bonus.

Up to 100% of every payment is matched into a benefit that tracks the market like a real investment. Get insurance that helps create wealth for your future.

WHY SANLAM INDIE?

Simpler, smarter, more rewarding life insurance.

Simpler, smarter, more rewarding life insurance.

We think life insurance should be more about living. So we’ve reinvented it to help you get on with life.

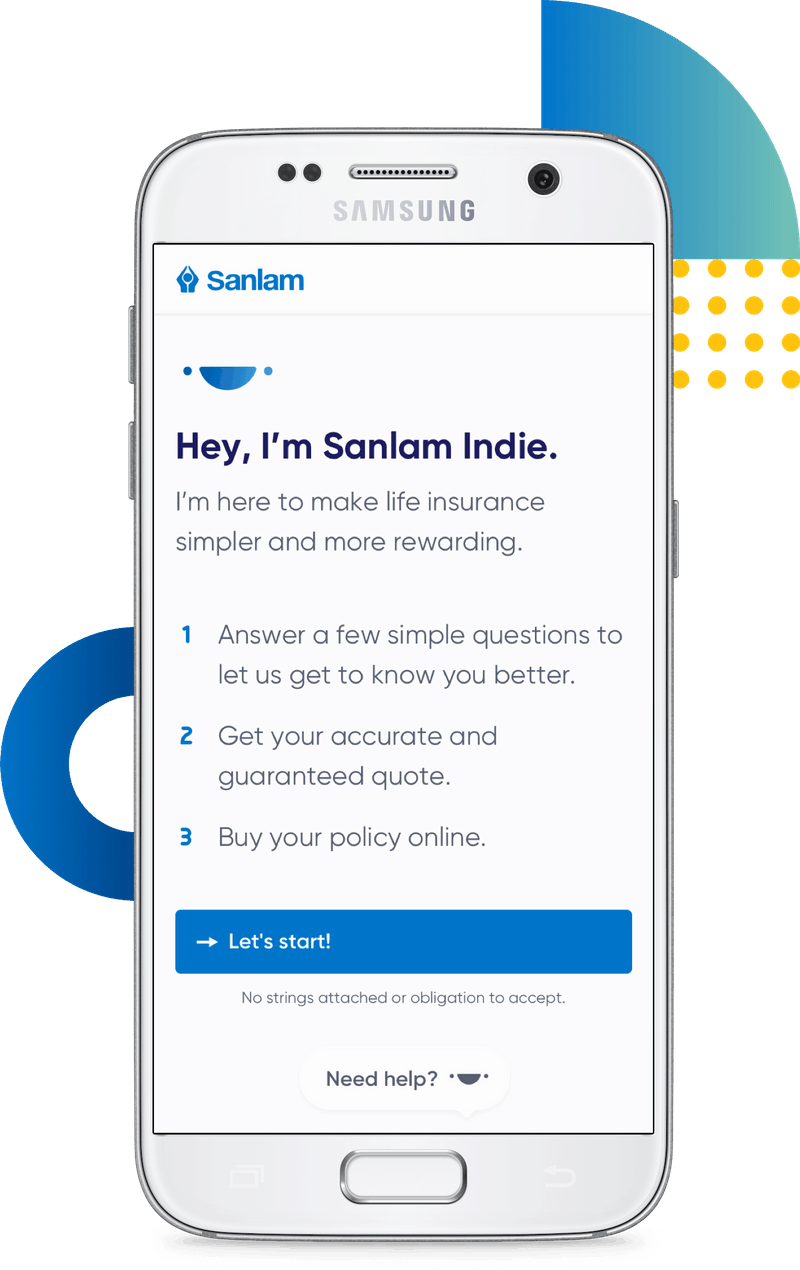

SANLAM INDIE PLAN

Not sure what insurance you need? We can help.

- Answer a few simple questions.

- We'll show you a plan and quote.

- Save your plan for later or get covered today.

100% no obligation to accept.

Get life insurance.

Get Wealth Bonus.

Get living.

Get world-class cover that rewards you with wealth while you're alive.

We're on a mission.

At Sanlam Indie, we're using cutting-edge technology to transform the industry and deliver financial services that actually work for you.

No jargon. No messy paperwork. Just world-class products that are simple to use, easy to understand, and incredibly rewarding - allowing more ways for you to create and protect wealth.

Copyright © Sanlam Indie 2022. All Rights Reserved. Sanlam Indie's product offering is underwritten by Sanlam Life Insurance Limited, a licensed life insurer & financial services provider. Sanlam Indie is a division of Sanlam Life Insurance Limited - Reg No. 1998/021121/06. Sanlam Life Insurance Limited is an authorised FSP (No. 2759). Address: 1st Floor Glacier Place, 1 Sportica Crescent, Tygervalley, Cape Town, 7530

Privacy | Terms of Use | Promotion of Access to Information Act